Forex Signals

Trading simplied

Forex Technical Analysis

Technical analysis is the backbone of Forex trading. Learn more about how traders use it

to study and predict price movements of different financial instruments.

What is Technical Analysis?

Technical analysis is the study of historical price action with the aim of spotting trends and patterns and determining probabilities of the future direction of price.

Technical traders (also known as technical analysts) believe that all important information about price movements lies within the charts. They believe that by looking at historical price movements, one is able to determine the current trading conditions and potential price movements. How?

Technical traders look for similar patterns that have formed in the past and form trade ideas based on the belief that price could possibly act the same way that it did in the past.

Using Technical Analysis To Trade The Forex Markets

Charts, or more specifically, price charts, happen to be the first (and most important) tool that every trader using technical analysis needs to learn. No matter their trading strategy, technical traders analyse these price charts in order to spot patterns, trends, find entry & exit points, predict price movement and more. These are the four most popular types of price charts used to trade foreign exchange:

Examples Of Technical Analysis Tools

Now that we have covered the definition of technical analysis, let's discuss some of the most popular ways technical analysts identify patterns and make predictions about future price movements in the Forex market. These fall within the following three categories:

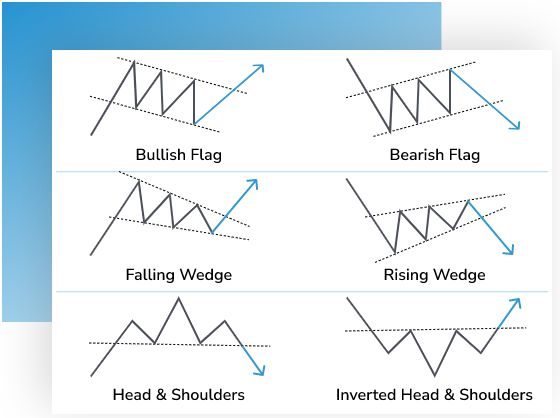

Chart Patterns

Chart patterns, perhaps better known as trading patterns, are shapes within price charts that play an integral part in helping traders predict what prices might do next, based on what they have done in the past.

To identify and spot chart patterns, technical analysts connect common price points, e.g. closing prices or highs or lows, during a specific period of time using drawing tools such as horizontal lines, trend lines, and more.

Chart patterns can be based on seconds, minutes, hours, and even days or months and can be applied to all chart types - line, candlestick, and bar Forex charts.

Some of the most popular chart patterns include wedges, head and shoulder formations, double and triple tops and bottoms, and flag

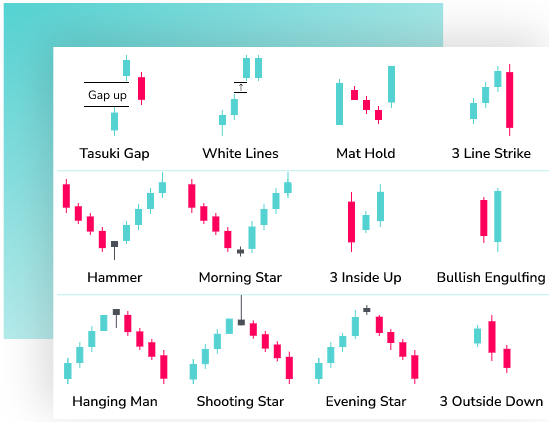

Candlestick Patterns

Candlestick patterns are powerful indicators used by Forex traders to predict the future direction of price movement and identify potential trading opportunities. Traders identify these patterns based on historical price data and trends.

Candlestick patterns are formed by grouping candlesticks in a certain way. Whether it's a reversal or continuation signal, candlestick patterns provide traders with an idea of what may be coming next.

There are three types of Candlestick patterns:

- Continuation Patterns (task gap, white lines, mat hold, line strike, separating lines)

- Bullish Reversal Patterns (hammer, morning star, three inside up, bullish engulfing)

- Continuation Patterns (task gap, white lines, mat hold, line strike, separating lines)

Technical Indicators

Forex technical indicators, or technicals for short, are an essential tool when trading the Forex market. These indicators provide traders with a better chance of making profitable trading decisions if used at the right time.

Forex technical indicators, or technicals for short, are an essential tool when trading the Forex market. These indicators provide traders with a better chance of making profitable trading decisions if used at the right time.

There is a wide variety of technical indicators out there to analyse trends, provide price averages, measure volatility, and they come in all shapes and sizes.

There is a wide variety of technical indicators out there to analyse trends, provide price averages, measure volatility, and they come in all shapes and sizes.

- Moving Averages

- Average True Range (ATR)

- Relative Strength Index (RSI)

- Stochastic Oscillator

Most Popular Technical Indicators

Whilst there are a lot of indicators to choose from, they are all used to either identify market state or recognise potential trading opportunities. Some of the most popular technical indicators are:

01 Moving Averages

Moving Averages, or MA in short, are popular trend indicators used by Forex traders that represent average closing prices of the market over a specific period of time.

Moving Average on a chart is displayed as a line that smoothes out price action and is a good indicator of the trend direction.

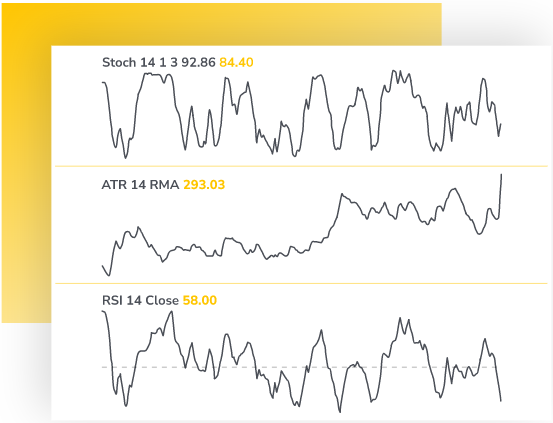

02 Stochastic Oscillator

The Stochastic oscillator is a technical indicator tool used by Forex traders to predict trend reversals.

It works on the theory that the momentum of a price change before the price actually changes its direction. On a chart, it is displayed as a two-line indicator that fluctuates between 0 and 100. As a result, forex traders use the Stochastic oscillator to predict trend reversals.

03 Average True Range (ATR)

The ATR is a popular volatility indicator that shows how much prices fluctuate, on average, during the specified period of time.

The ATR indicator is displayed as a single line in a section underneath your chart that can move up or down. The higher ATR, the higher volatility, whilst the lower ATR, the lower volatility.

However, it is important to note that this indicator doesn't provide signals about potential trend direction, but instead it shows what is happening with the price volatility.

04 Relative Strength Index (RSI)

The relative strength index is a popular oscillating momentum indicator used to measure the strength (or weakness) of currency pairs by comparing their upward movements versus their downward movements over a specified period of time.

On a chart, the RSI is displayed as an oscillator and can range from 0 to 100. Forex traders believe that if the RSI indicator is at around the 70 level - the currency pair is overbought, whilst a currency pair at around the 30 level is oversold.

World's most advanced Trading Room

Join ForexSignals.com and let our educational lessons, daily live streams and community help you understand the financial markets.