Forex Signals

Trading simplied

WEEKLY FOREX FORECAS

August 22, 2022 09:02:12 AM

Sent to your inbox every Monday!

See what’s hot and what’s not in the Forex market for free with just a click of a button.

By clicking the 'Subscribe' button you agree to our Terms of Service and Privacy Policy.

USD

Strongest

CAD

Weak

EUR

Strong

GBP

Neutral

AUD

Weak

NZD

Weakest

CHF

Strong

JPY

Neutral

View our Currency Heat Map

DOLLAR VERY MUCH IN FOCUS THIS WEEK

August 22, 09:02:12 AM

Nick Quinn, Mentor

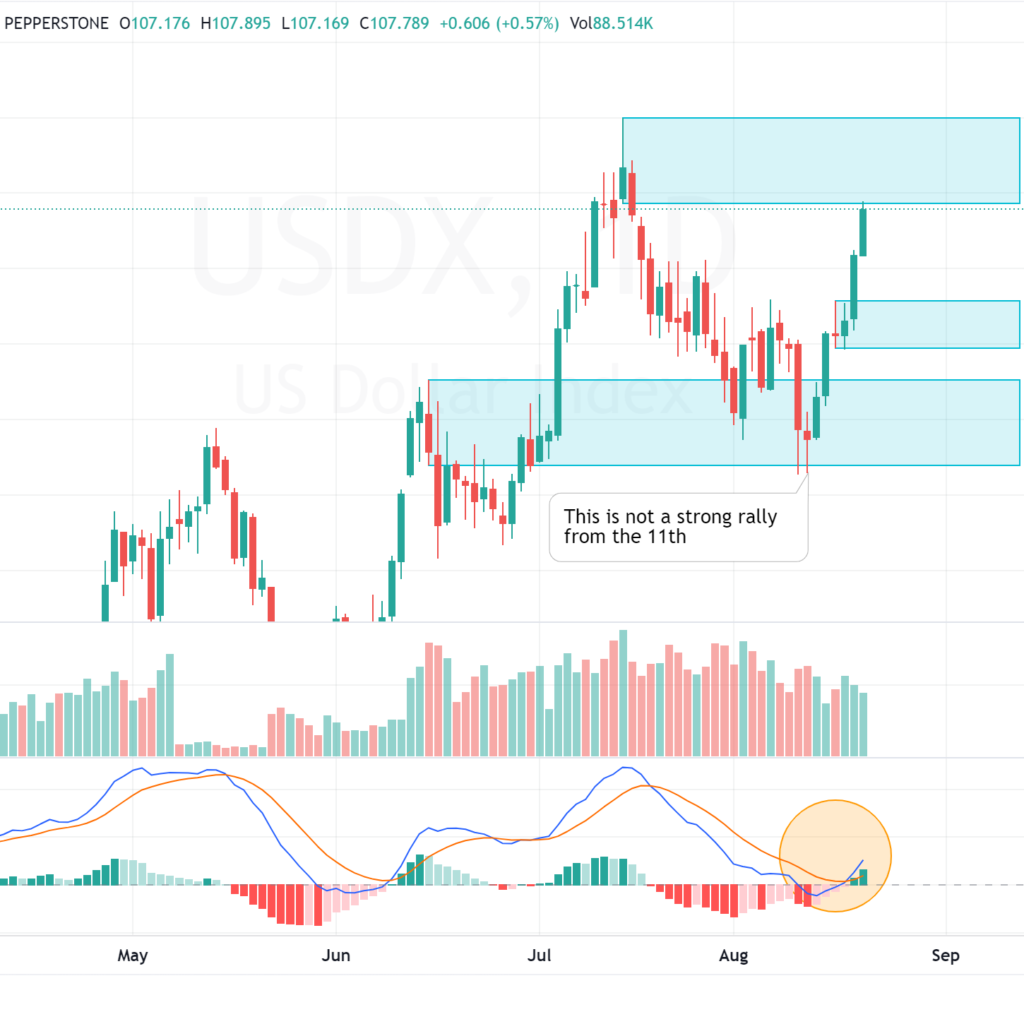

This will be an important week for the dollar. August volatility has gotten the bulls in the mood for a push past the July highs.

It is possible, but the rally from the 11th isn’t built on the strongest platform!

Jackson Hole marks the end of the week on Friday. Powell's speech will come right on the back of the highly anticipated PCE inflation readings. Any contradiction to CPI could really create some wild swings as the market tries to gauge just how hawkish Powell will sound.

Commercial Hedgers have still not shown much interest in reversing course for the dollar so I favor an increase in volatility rather than clarity of direction.

As the summer season approaches its end it’s easy to get sucked into thin markets believing you’re ‘in at the top’ or ‘bottom’.

Stay sharp as true trend support doesn’t really start till we drop back to the early 106’s.

Nick Quinn, Mentor

Hi I'm Nick and have been trading since 2008. I've traded most asset classes - equities, fixed income and commodities. However, my preference has always been spot market foreign exchange. My style is big picture macro position trading in CFD's and currency futures contracts.

BEARISH ON METALS

August 22, 08:55:10 AM

Max Norbury, Mentor

Now that we have just broken through the major median zone of the range, Platinum is seemingly weaker and the runaway train is speeding up.

Last week, the bearish bias down to the lower limit of the trend was achieved shortly after the report was released but instead of respecting the lower limit, it was in fact crushed!

Price came back to retest this area before plunging a further 7%. XPT currently trading at around 875.500.

This week I am looking for continued shorts in this precious metal and believe we could be on our way down to the lower equilibrium limit at approximately 830.000.

Benchmark 10-year Treasury yields rose to their highest in a month, increasing the opportunity cost for investing in precious metals leading to further liquidity flowing away and not into the market.

We also have the FED hanging over investor sentiment with the likelihood of a 50 basis point rise in September becoming evermore prominent.

The main focus this week remember will be on the discussions led by Fed Chair Powell when he addresses the annual global central banking conference in Jackson Hole on Friday. (Remember what was discussed last week on this topic, Friday will be a big one for policy decisions!)

Good luck folks and as always, trade safe.

Max Norbury, Mentor

Max Norbury - Expertise in Equilibrium theory, Market state-structure, Inter-market correlation, Multi-asset class portfolio management, Macro and Global econ and arguably the best entertainer in the trading-room. (Or so he likes think...)

- Forex / Stocks / Commodities

- Technical / Fundamental analysis

August 22, 07:52:48 AM

Shain Vernier, Mentor

Last week was rough for risk assets as crypto and shares posted significant pullbacks. For the US indices, the negative action snapped a four-week winning streak. Will “risk on” be back in vogue in the coming five days? Let’s check out the important economic events and see if we can spot a few potential market drivers.

Monday

The trading slate kicks off with a wide-open economic calendar. The headliner will be the PBoC Loan Prime Rate release out of China. PBoC officials announced a surprise rate cut last Monday in response to fresh COVID-19 challenges. Many analysts expect the PBoC to go dovish once again; if so, we could be in for some action in the yuan pairs and China50.

Key Markets: CNY pairs, China50, US indices

Tuesday

The Asia-Pacific session features the Bank of Japan (BoJ) Core CPI. If you’re trading the JPY, don’t look past this number! Although it’s listed as a peripheral metric, anything to do with inflation can quickly roil markets.

During the London trading day, service and manufacturing PMI statistics are due out. Be on the watch for volatility in the GBP as these reports hit newswires. In the US, New Home Sales (July) is scheduled for release. Analysts expect the figure to come in at 575,000, down from 590,000 in June. Given the contraction in US real estate and higher cost of capital, this number is poised to disappoint expectations. If so, the USD may experience weakness in anticipation of a Fed pivot from hawkish policy.

Key Markets: US30, US100, US500, FX majors, BoJ pairs

Wednesday

Mid-week trade features a modest lineup of official reports. The highlight will be Core Durable Goods Orders (July). Consensus estimates have this figure coming in at 0.2% from 0.4% month-over-month. Should the contraction be more severe than expected, the Wall Street talking heads will be screaming “recession!” from the mountaintops.

A bit later in the US session, Pending Home Sales (July) is due out. On a percentage basis, sales are actually projected to improve from -8.6% to -3.8%. Of course, home sales are still well off five-year averages for the season. And, don’t forget the EIA Crude Oil Inventory report!

Key Markets: US30, US100, US500, FX majors, WTI crude oil

Thursday

Thursday’s London session gets underway with Germany’s GDP (Q2). Figures are slated to come in flat year-over-year at 1.5%. On a quarterly basis, it’s anyone’s guess where these reports will actually land. However, with recession on everyone’s mind, German GDP is likely to drive action to the euro (EUR).

Later in the day, the ECB Account of Monetary Policy Meeting will be released to the public. Many think last week’s FOMC Minutes were the primary driver of USD strength; will this drive the EUR higher?

The American session features revised GDP (Q2). Most believe GDP to hold firm at -0.8%, down modestly from Q1’s -0.9%. Don’t be surprised if Q2 GDP is revised upward, in line with the skepticism from Jerome Powell and Biden administration before the initial release.

Key Markets: EUR pairs, FX majors, US indices, GOLD

Friday

Late-week trade begins with the Tokyo CPI and Core CPI (August). The market is expecting Core CPI to rise from 2.3% to 2.5% year-over-year. If this comes to pass, will the BoJ finally begin considering a rate hike toward the yen? It’s unlikely, but certainly possible.

The markets will be watching Friday’s US Core PCE Price Index (July) very closely. The number is projected to fall dramatically from 0.6% to 0.3%. Should this be the case, 2022’s Fed rate hikes will be lauded as successful. Falling Core PCE may be a precursor for a pullback in the August CPI number. Ultimately, this could be the beginning of the Fed walking back the hawkish narrative.

Key Markets: JPY pairs, GOLD, FX majors

Bottom Line

We are all set for another big week of action on the markets. Inflationary metrics will be critical, capped off by Friday’s US Core PCE numbers. It’s an excellent time to be in the markets, and we’ll see you in the trading room!

Shain Vernier, Mentor

Active trader, How To Trade (HTT) Mentor. University of Montana, Business Finance (2002). Participated in intercollegiate baseball, NWAC & NCAA 1997-2001. 10+ years of market experience, hybrid trader, combination of technical and fundamental analysis.

Explore the top five global events this week that may have a significant effect on the Forex market. If you'd like to explore more key global events on the horizon that could subtly shift or substantially shake up the financial markets, please click below.

Catch every live stream and every comment at every opportunity. Trade with our mentors by tuning into one of our 6 daily live streams. Oh and feel free to ask any questions throughout! Sound good? Join us for the upcoming Live Stream in just a few minutes! You can see the schedule below.

USD

Strongest

CAD

Weak

EUR

Strong

GBP

Neutral

AUD

Weak

NZD

Weakest

CHF

Strong

JYP

Neutral

FAQs

You have access to our daily live streams, educational resources, community trade ideas and discussions.

We’ve lots to offer here and we have all different types of traders, from all around the world. We’re for the traders out there that are looking to learn strategies, excel in their learning, and have the ambition to be consistent in the markets. We’re suitable for completely new traders that want to learn the very basics, all the way up to the most advanced level of professional traders.

We’re for traders that are tired of trading alone, and want to be part of a community; to get direction from experienced trading mentors so they can refine their trading performance. Remember, we offer so much more than just trading signals and if you’re looking for signals only, then we’re probably not the right place for you; signals alone will not make you a successful trader.

Here at ForexSignals.com we see the same thing time and time again; traders that end up in thecycle of doom, don’t backtest and simply burn through trading strategies. Based on research, we’ve found that traders tend to fail for a number of reasons but the most common is lack of discipline. When you havefound a strategy that suits your style of trading, stick to it! Set rules, print your strategy rules off, and follow them! No matter how hard it is, do not let your emotions get in the way and control your forex trades.

Inside the trading room, we have a number of strategies we can educate you on.

Yes, anyone can learn how to trade Forex – the real question is how much time are you willing to put in to properly master the markets? Forex trading (or foreign exchange trading) is a skill and like any skill, it takes time to learn, feel confident, optimise and succeed. You will not learn how to trade Forex overnight and you will not make money long-term with trading signals. Forex signals alone are not enough to succeed and you should think very carefully before you trade blindly with signals you do not fully understand. If you want to become a successful trader you really need to learn how to start trading Forex.

At ForexSignals.com we keep things simple and will offer you direction along the way. We’ve watched traders with zero knowledge grow with us into successful traders.

Ourtrading room has a community of thousands and every day, at any given time, hundreds of traders are active and helping each other. We have four experienced trading mentors that live stream throughout the day, share trade bias, help you evaluate your own trades, discuss opportunities in the markets, educate you on trading strategies, and much more.

We’ve helped over 83,000 traders and we have no plans to stop now. Inside the trading room, you will also find world-class educational videos to watch in your own time – these are useful no matter your level of trading knowledge. We have also developed premium proprietary Forex tools that you can download from inside thetrading room.

We have three experienced trading mentors inside the trading room. Andrew, Mark and Max together have over 55 years of forex trading experience. They will provide you with market commentary, trade bias, guidance and education in the following markets; Forex, Crypto, Stocks, Commodities, Futures, Options and more.

Despite our name, we are not a pure forex signals provider. We are very transparent and tell all of our traders that using forex signals alone is not enough to make you a consistently successful trader. Our community shares its best forex signals and trade ideas – and you will get trading alerts every day as the free forex signals are published. You can also share your best forex signals for community feedback, so you can take your trade with confidence. Signals providers in recent years have exploded in presence on social media, but please make sure if you are looking for forex signal services that you do your due diligence.

Many forex signal providers claim they offer you ‘the best forex signals’ out there, but trust us, we know that this is often not the case and spammers are rife in the industry. If at any time you would like more information on why using a free forex signal provider is not the real way to make a career trading, then come and chat to us on our 24/7 live chat and we will explain how signals providers work.

At Forex Signals we offer much more. We’re focused on world-class trading education and teaching you the skills so you’ll never need to rely on a signal provider that offers forex signal service.

Discipline. Focus. Hard-work. Dedication. Patience. Realistic expectations. Also, control of your trading mindset and strategy takes you on the right path.

Find a trading strategy that suits your trading style and then, stick to it. If you don’t stick to a trading strategy and plan, you will most likely end up in thecycle of doom.

MetaTrader 4 and MetaTrader 5 are the world’s most popular trading platforms. This is where you will look at your charts, perform technical analysis, plan your trades and execute your trades. Every day millions of retail traders use this trading platform to trade the forex markets.

To get your hands on MT4 or MT5 you will need to register with a trading broker. When you register with a broker, they will almost always usually provide you with your very own MT4/MT5 trading terminal – they will send you MT4 log-ins, and you can trade via a demo or live trading account. You can see a list of brokers we have comparedhere.

Once you have your MT4/MT5 trading platform, learn how to set up your Metatrader here.

Watch a short video prepared by our lead mentor Andrew Lockwood where he will show you around MT4 and share useful shortcutshere.

If you are trading Forex, you are trading on the foreign exchange. On the foreign exchange, you are trading world currencies against each other. The Forex market is often referred to as the ‘FX market’. The Forex market is the most liquid market in the world, with over 6 trillion dollars traded on the market every single day! It’s bigger than the stock market!

Forex trading is the buying and selling between a forex ‘currency pair’ including the major currencies, the minor currency pairs and the exotics currency pairs. There are over 100 currency pairs and the most popular currency is the USD.

The most frequently traded forex pairs are: EUR/USD, USD/JPY, GBP/USD, USD/CAD.

Minor pairs that do not include the U.S. Dollar. These pairs typically contain one of the other three major currencies: EUR, GBP, or JPY. Finally, exotic pairs include currency pairs from countries with a developing market presence, such as Sweden, Norway, or Mexico.

The Forex market is an excited and fast-paced market, hence, it appeals to a lot of ‘retail traders’. You probably have participated in the Forex market without even realising it. For example, if you are from the United Kingdom and you plan to go on holiday to the United States, you will of course need dollars (USD) to spend.

You might go online or to a currency counter to purchase USD and you would be doing so at the current exchange rate. Then, when you return home from your holiday, you might have USD left. You return to the currency counter and ask to change your leftover USD back into GBP, but whilst you have been away, the currency exchange rate has moved, meaning you can get back more GBP than you had originally used to purchase your USD, therefore, you have made a profit from your exchange.

The Forex market is unique as there is no central marketplace. This means all transactions are done electronically across networks. Also, unlike other markets, the Forex market can be traded around the clock 24 hours a day, 5 days a week (Monday – Friday).

Andrew Lockwood, an experienced Forex trader explains what trading Forex is in this short video.

You can also adopt different trading styles to suit your needs. For example, you may find that you are more of aSwing Trader or a Scalper.

Yes. If you feel you are not ready to get stuck into our Trading Room and want to learn the very basics of trading before becoming a paid member with Forex Signals, then why not check out our other website HowToTrade.com. There we providefree courses for very new traders.

We’re always up for a chat. Click in the bottom right corner of this website to chat to our 24/7 live chat team, or head over to our FAQshere.