Forex Signals

Trading simplied

Forex divergence

Learn more about trading divergence in forex and how you can

use it to trade the markets.

What is divergence ?

Divergence is a popular term in technical analysis that describes when the price of an asset is moving in the opposite direction of a technical indicator.

For instance, if the currency price is moving up, but a technical indicator (e.g. oscillator) is moving in the opposite direction. When it comes to trading divergences, there are two types and each contain either a bullish bias or a bearish bias.

The divergence types are:

- Regular divergence

- Hidden divergence

What is Regular Divergence ?

Regular divergence is a signal of a possible trend reversal. Regular divergence can be spotted when the pair makes higher highs or lower lows while the indicator doesn't follow this pattern. This indicates an early warning for traders that the trend could be coming to an end soo

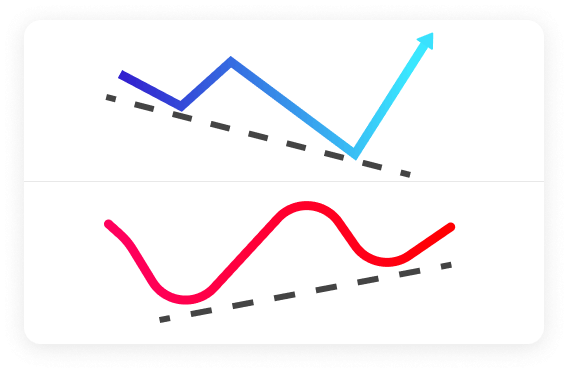

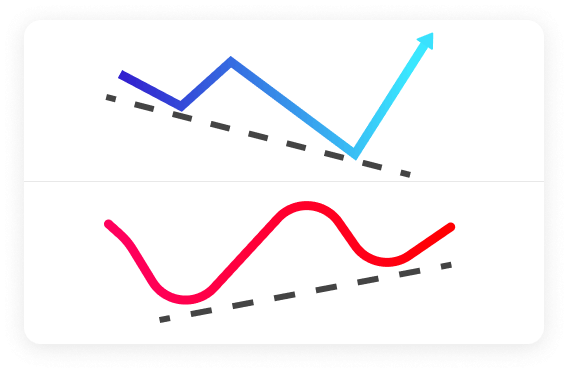

Regular Bullish Divergence

Regular Bullish Divergence indicates underlying strength. Regular Bullish Divergence occurs as a warning of a potential change of trend direction from a downtrend to an uptrend.

- Price: Lower Low

- Indicator: Higher Low

Regular Bearish Divergence

Regular Bearish Divergence indicates underlying weakness. Traders believe that it is a warning of a potential change of trend direction from an uptrend to a downtrend.

- Price: Higher High

- Indicator: Lower High

What is Hidden Divergence?

Hidden divergence is a signal of possible trend continuation. It gets its name from the fact that it is not always easy to spot. Hidden divergence occurs when an indicator makes a higher high or low whilst the price action does not. Hidden divergence occurs within an existing trend and indicates that there is still strength in the prevailing trend and that the trend will resume.

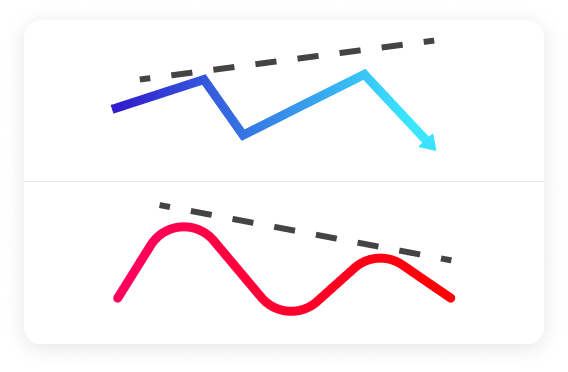

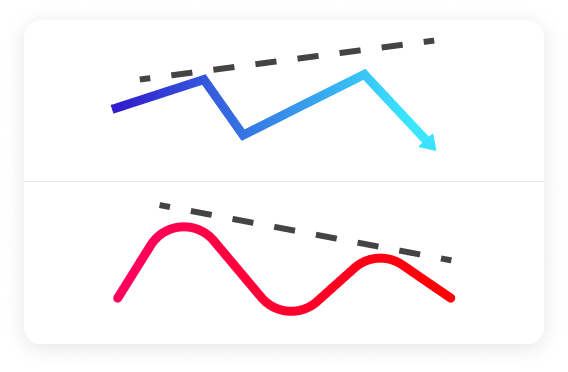

Hidden Bearish Divergence

Hidden Bearish Divergence indicates underlying weakness and can be found when the pair is in a downtrend.Hidden Bearish Divergence can be found when price makes a lower high, but the indicator is making a higher high. When you spot this on your chart, chances are that the currency pair will continue the downtrend.

- Price: Lower High

- Indicator: Higher High

Hidden Bullish Divergence

Hidden Bullish Divergence indicates underlying strength and hidden bullish divergence occurs when the pair is in an uptrend. Once price makes a higher low (HL), look and see if your indicator follows the price. If it does not and in fact makes a lower low (LL), then that's what you call hidden divergence. Or in other words, this divergence pattern screams 'buy the dips'.

- Price: Higher Low

- Indicator: Lower Low

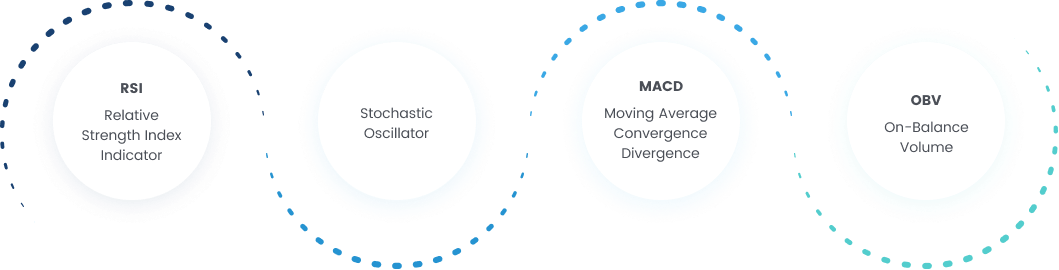

What indicator can you use to trade divergence?

There are different indicators traders can use to identify divergence. Some of the most popular ones include:

Use Forex Signals tools for more in-depth analysis

Economic Calendar

Our economic calendar showcases relevant events to help you trade these markets too.

Lot Size Calculator

Calculate the correct lot size for your trade depending on your risk appetite. Enter your entry price and check your risk tolerance.

Profit Calculator

Use our profit calculator to calculate the possible profit from a trade you are considering taking.

Currency Heat Map

Use our free currency heat map to determine the strongest and the weakest currencies on the forex market today.

Absorb our expertise.

Grow in the

best community.

Start a free trial today and join our Trading Room. Our experienced Forex mentors and community

of many currency traders are ready to help you on your trading journey! Watch the short demo below and see what's inside!